Top tips for implementing personalized CX

CX Network shares experts tips for rolling out personalized CX solutions

Add bookmark

This article explores how companies can ensure personalized customer experience throughout their business.

• Using Voice of the Customer

• Ensure you have a complete view of customer data

• Introduce automated CX solutions

• How HSBC increased customer satisfaction using personalization

Using voice of the customer

CX Network’s own research for the Big Book of Customer Data, Insight and Analytics 2022 found that 41 percent of CX professionals use process improvement from feedback to personalize CX. By collecting Voice of Customer (VOC) data, companies can use this to introduce and improve their personalized CX solutions.

When looking to improve processes from customer feedback, companies should not only listen to customer feedback, but plan, prioritize and act upon it.

Ayelet Mendel-Girin, group head of CX at Australian fintech company Humm Group and CX Network board member, says it is important brands identify the data sources that can be mined to produce the relevant customer data for the experience they wish to create.

By noting these sources, brands can collect the type of data needed to personalize CX in a way that their customers connect with.

Ensure you have a complete view of customer data

When collecting data through VOC programs, it is vital that companies ensure they have a complete view of said data. To do this, David Wray, global accounting and reporting senior director at Huawei, suggests that companies store all data in a repository such as a cloud environment or data lake.

Wray explains: “This will allow you to start to extract value from the data, whether its structured or unstructured, [in the form of] intelligent analytics insights.”

Related content: Why personalization is crucial for CX success

Introduce automated CX solutions

Automation can also be used as part of a personalized CX offering. One way this can be done is through the introduction of conversational AI, which works by applying Natural Language Understanding (NLU) to customer intent throughout a conversation with a customer.

By utilizing conversational AI, companies can provide customers with the correct tools to solve their queries and free up employees by automating repetitive and low complexity enquiries.

By using conversational AI, companies can measure their baseline performance, which can then be used to track the effectiveness of personalization. This technology can even allow companies to run a side-by-side comparison of personalized experiences verses their current, non-personalized interactions.

By using this testing model, companies can tangibly demonstrate the value of personalized CX by using a combination of customer testing and employee feedback. From there, stakeholders are equipped with quantitative and qualitative data to make the appropriate decisions to implement a successful CX strategy for their business.

Related content: The lowdown on ChatGPT and what it thinks of CX

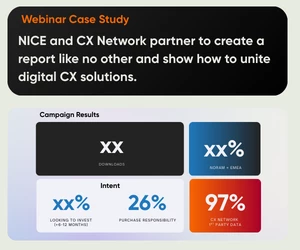

How HSBC increased customer satisfaction using personalization

HSBC introduced Conversation Builder, an intelligent automation (IA) solution in April 2019 to help it grow customer interactions. Conversation Builder enabled the bank’s near 20,000 agents to create bots based on their own conversational understanding and expertise.

With HSBC expecting messaging to account for more than 50 percent of contact center interactions by the end of 2023, this move to IA is crucial to allowing experts on customer conversations to step up and develop the bots of the future.

Warren Buckley, global head of channel optimization and contact centers at HSBC, explains how these bots help lighten the pressure put on agents by eliminating repetitive simple tasks.

“Being able to easily blend human empathy with intelligent automation has been crucial to our success.

“Our frontline team now has control over its own destiny and can operate with increased agility – faster and smarter than ever before – to get our customers the resolutions they are seeking,” Buckley remarks.

By using IA HSBC was able to create and introduce a fully functional bot with 15 intentions. It saw messaging become the channel of choice for frontline agents and saw customer satisfaction (CSAT) scores track at more than 90 percent week on week within five months of implementation.

If you found this article helpful, you can share it with your professional network on LinkedIn or with the wider world on Twitter