Six consumer spending developments reshaping retail

Early data on the Golden Quarter shows significant changes in how and when customers spend

Add bookmark

Taking place from November to January, the Golden Quarter is retail’s big season and it includes Black Friday, Cyber Monday, Christmas shopping and January sales.

In the current economic climate, many are expecting 2022’s Golden Quarter to be less profitable than in previous years. As early figures from Black Friday and Cyber Monday suggest, however, this may not be the case.

CX Network takes a closer look at six emerging trends that show how consumer priorities and habits are bucking expectations.

Consumers are spending big in 2022

Consumers in the US may have been expecting to spend more on gifts this holiday season, but this does not mean they are willing to pay more for goods that only a few months ago cost less.

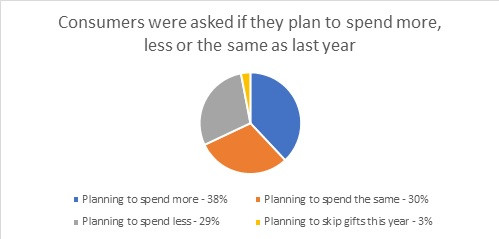

A survey conducted by MoneyTransfers.com and OnePoll confirmed that more than one third of shoppers plan to spend more on Christmas gifts this year despite – not because of – rising prices.

The picture below shows a more detailed breakdown:

Jonathan Merry, CEO of MoneyTransfers.com, says: "Despite the cost of living being the highest it has been in years, consumers are still planning on embracing the festive season and the added expense that comes with this time of year. While this is no doubt good news for the retailers who rely heavily on additional spending over the holiday season, the worry, of course, is that families are spending more than they can afford in order to keep up with traditions."

There are further patterns in who the big spenders are – and where they are located.

The survey found 47 percent of male respondents in all locations plan to spend more and 34 percent of male and female respondents in the US Midwest also plan to spend more. Meanwhile, over the pond, British consumers are expected to spend 60 percent less on Christmas shopping.

In the US the average consumer is set to spend approximately US$932 on Christmas gifts – an increase of five percent in 2021 and the highest estimated gift spend in more than 20 years.

But their spending patterns have changed

One analysis of Black Friday weekend has found that retail was not the big focus for consumers and that 25 November was not the biggest day for shopping that weekend.

Crunching data from Mastercard SpendingPulse and Adobe Digital, Fair Betting Sites found consumers spent more on restaurants than apparel and that Cyber Monday saw more overall sales than Black Friday.

This graph shows the Black Friday sales increases by segment:

This graph shows sales volumes over the post-Thanksgiving weekend:

In conclusion, Fair Betting Sites said total Black Friday sales were up four percent and that toys and electronics saw the most sales.

Customers want to talk

Messaging remains a key contact channel for customers when they have queries, questions or problems to solve.

Emarsys has already analyzed the volume of cross-channel retail messages delivered from 25-29 November, that is Black Friday to Cyber Monday 2022. Its research confirmed that overall message volumes were up 45 percent.

Channel by channel, Emarsys shared the following breakdown:

The insights place an even greater focus on omnichannel, as Forrester Consulting also confirmed. It found that 62 percent of businesses believe their omnichannel strategy has yielded higher margins, while 54 percent said it has brought greater customer loyalty and retention.

Experience heavily influences where customers shop

Insights from Twilio found that while retailers are getting better at delivering great CX, 55 percent of customers still think their queries are not dealt with efficiently.

In fact, there are many reasons why customers are finding their experiences unenjoyable. Twilio said 30 percent think retail customer service could be more efficient while 24 percent said they would rather get trapped in a lift with someone they don’t like, than have to deal with a customer service department.

Twilio customer engagement consultant Sam Richardson, says: “Retailers must remember that customer service is not an island. Customer support agents need access to information from across the customer journey in front of them to offer insights and propose solutions.

“Centralizing and analyzing first-party customer data dramatically improves customer care, and it can also arm retailers with the information they need to improve more complex customer journeys like the returns process.”

Twilio also found that, despite the spike in messaging identified by Emarsys, 64 percent of retail customers prefer to speak to a human agent, while 47 percent are happy using automated messaging services if it means their issue is going to be resolved.

Still, only 10 percent are expected to shop exclusively in store

This holiday season is likely to see reduced footfall in brick-and-mortar stores. Twilio found only 10 percent of shoppers plan to shop exclusively in-store this festive season.

It doesn’t take a mathematician to figure out that this means 90 percent of consumers will use digital tools and platforms to make some or all of their festive purchases this year.

BNPL is getting more popular

A sign of the times, during the Black Friday and Cyber Monday sales of 2022, the use of Buy Now Pay Later (BNPL) apps increased by 78 percent, according to Moneytransfer.com. No doubt this helped the 12 percent year-on-year sales increase seen during Black Friday in the US.

This could be the spending trend to watch, however, as a heavy reliance on BNPL signals a wider economic issue. You can read more about the trend in this article by Humm Group’s Ayelet Mendel-Girin.

MoneyTransfers.com also found more than half of the people who use BNPL do so out of necessity and a quarter of BNPL users see their total debt increase.

Merry says: “While the economy needs spending, and data on Black Friday sales is generally more positive than expected, consumers should be careful that they don’t put themselves in a dangerous position here. BNPL could serve a useful purpose but there needs to be more education around how to use it – and how it can impact consumers’ lives.”