16-17 March 2026

Power the Person. Elevate the Experience

The CX BFSI Exchange returns 16–17 March for its 15th edition as the UK’s premier invitation-only forum for C-Level CX, Operations, Digital and Transformation leaders in financial services. With Chatham House Rules in place, benefit from case studies, collaborative think tanks, and personalised agendas - with exclusive access to the UK’s most forward-thinking institutions to delve into data, build empathy-driven journeys & scale AI responsibly to shape strategies that deliver differentiated, loyalty-driving end-to-end customer experiences.

Connect Data, Empathy & Experience to Deliver Meaningful

Customer & Commercial Outcomes

Make Smarter CX Decisions - ROI Uncovered

Although evidence continues to build around the business value of CX, the pressure to demonstrate its measurable economic impact is intensifying.

Amid sceptical leadership, data limitations and shrinking budgets, proving the value of CX often determines whether programmes expand…or face cuts.

This March, discover how your BFSI peers are realising measurable gains through digital transformation and technology innovation - so you can confidently prioritise investments that maximise CX impact and build stronger alignment with your commercial teams.

Capitalising on AI for Operational & CX Gains

AI is no longer experimental – it’s a business critical capability to master.

As the next phase of CX excellence depends on how effectively organisations harness the full potential of AI, ensuring its scalable and ethical implementation will be critical to realising that vision.

Through case studies and interactive roundtables, learn how financial institutions are reimagining operations and driving smarter, faster and more personalised financial services, to take away a clear AI implementation roadmap built on robust guardrails and ‘human in the loop’ oversight.

From Fraud Prevention to Relationship Building

As digital channels expand, fraud risk has exploded - worsened by the cost-of-living crisis and AI-enabled scams.

With the ‘cat-and-mouse’ game between businesses and fraudsters reaching new levels of intensity and cost, see how businesses are applying consistent vigilance and evolution of fraud capabilities to take fraud from a top complaint to a differentiating strength – creating experiences where customers feel secure, not slowed down.

Accessible Finance & Delivering on Consumer Duty Outcomes

Two years after Consumer Duty’s launch, organisations are still embedding it in culture, KPIs and service design. The challenge is sustaining momentum beyond compliance.

Benchmark against organisations leading the way in customer-first culture, as where compliance is fully operationalised, accessibility to financial services improves,

C-level leaders are engaged and measurable customer outcomes are achieved. Leave equipped to build your own blueprint for embedding a customer focus into the heart of every strategic decision.

WHAT TO EXPECT

15th Annual CX BFSI UK Exchange Will Feature

80+

Attendees

25+

Speakers

15+

Sponsors

150+

1:1 Meetings

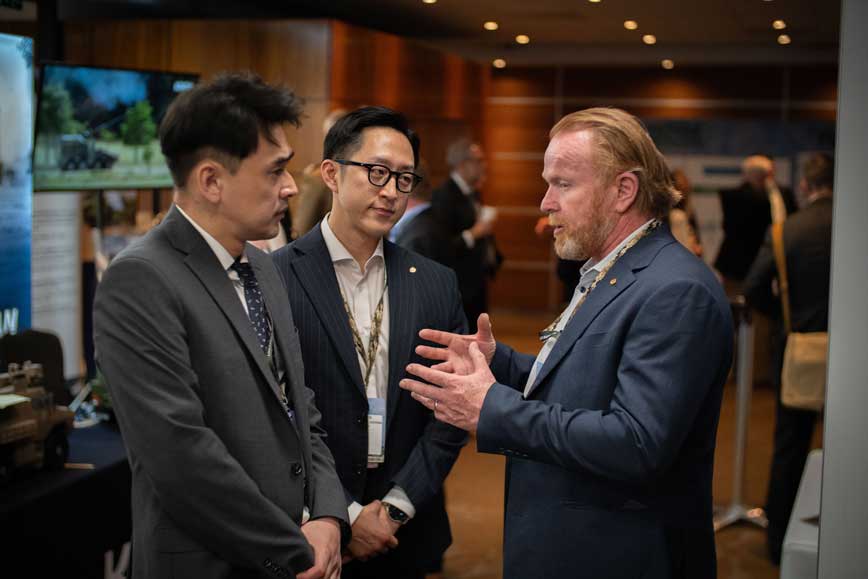

Sponsorship and Exhibition Opportunities

Sponsorship is the most effective solution to share your company’s idea to senior professionals from across the BFSI space, who are searching for actionable CX solutions.

CX BFSI Exchange brings together senior decision-makers all looking to spend within the short-medium term and ready to take prequalified, prescheduled. 1:1 meetings.